Cherokee inc traditional income statement – Cherokee Inc.’s traditional income statement serves as a crucial financial document that provides insights into the company’s financial performance over a specific period. This comprehensive analysis delves into the intricacies of the income statement, examining its components, exploring revenue recognition methods, and assessing key factors that influence the company’s financial health.

By understanding the traditional income statement, stakeholders can gain valuable insights into Cherokee Inc.’s financial strengths and weaknesses, enabling them to make informed decisions and identify areas for potential improvement.

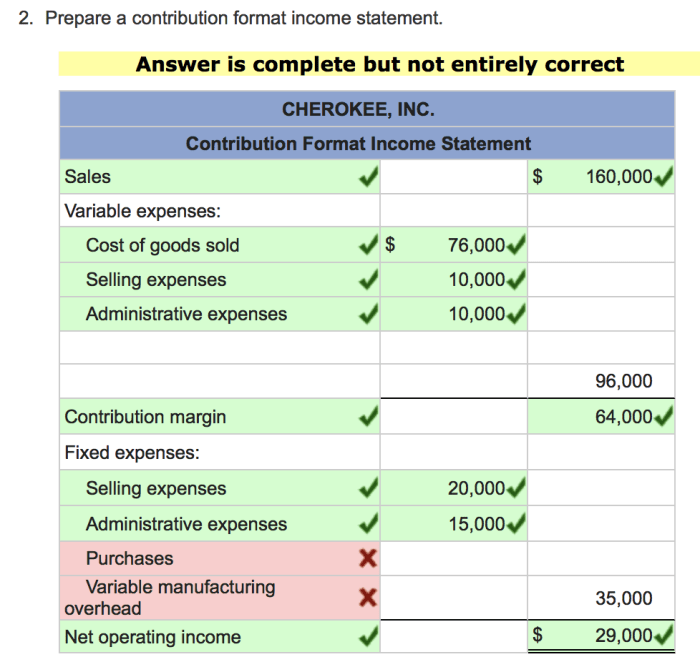

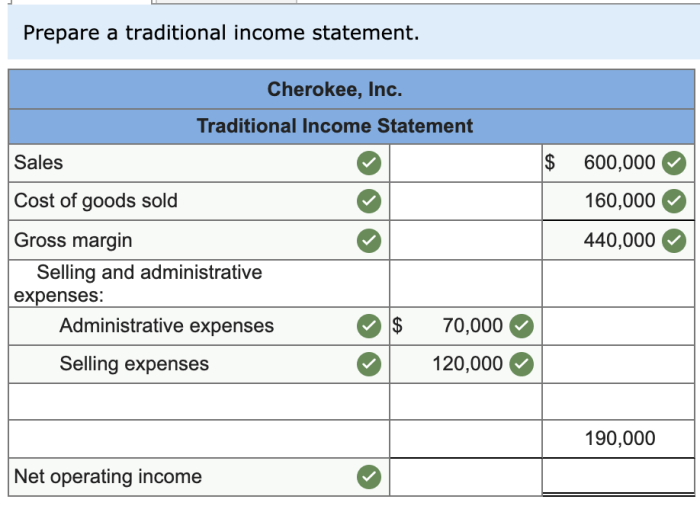

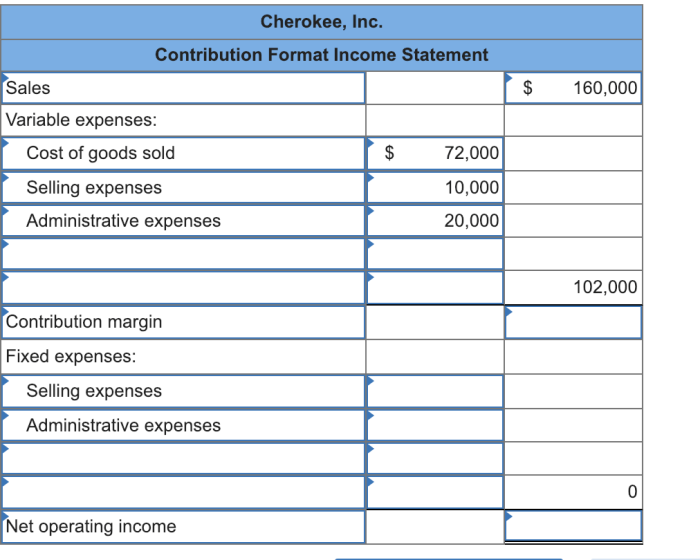

Traditional Income Statement for Cherokee Inc.

A traditional income statement presents a company’s financial performance over a specific period of time, typically a quarter or a year. It provides a summary of the company’s revenues, expenses, and net income.

The format of a traditional income statement is as follows:

- Revenues

- Cost of goods sold

- Gross profit

- Operating expenses

- Operating income

- Non-operating income (expenses)

- Pretax income

- Income taxes

- Net income

The following is an example of a traditional income statement for Cherokee Inc. for the year ended December 31, 2022:

| Amount (in millions) | |

|---|---|

| Revenues | $10,000 |

| Cost of goods sold | (6,000) |

| Gross profit | $4,000 |

| Operating expenses | (2,500) |

| Operating income | $1,500 |

| Non-operating income | 100 |

| Pretax income | $1,600 |

| Income taxes | (400) |

| Net income | $1,200 |

The key components of a traditional income statement are:

- Revenues: This represents the total amount of money that a company has earned from its operations.

- Cost of goods sold: This represents the direct costs of producing the goods or services that a company sells.

- Gross profit: This represents the difference between revenues and cost of goods sold.

- Operating expenses: These are the indirect costs of running a business, such as rent, salaries, and marketing.

- Operating income: This represents the difference between gross profit and operating expenses.

- Non-operating income (expenses): These are income or expenses that are not related to the company’s core operations, such as interest income or gains on investments.

- Pretax income: This represents the difference between operating income and non-operating income.

- Income taxes: These are the taxes that a company owes on its income.

- Net income: This represents the difference between pretax income and income taxes.

- The risk of bad debts: Cherokee Inc. may not collect all of the revenue that it records. This can lead to a loss of income.

- The risk of fraud: Cherokee Inc. may be exposed to fraud by its customers or employees. This can lead to a loss of revenue.

- The risk of changes in accounting standards: The accounting standards for revenue recognition may change. This can lead to Cherokee Inc. having to change the way that it records revenue.

- The cost of materials: The cost of materials can fluctuate due to a number of factors, such as changes in supply and demand.

- The cost of labor: The cost of labor can fluctuate due to a number of factors, such as changes in the minimum wage or the availability of skilled workers.

- The cost of overhead: The cost of overhead can fluctuate due to a number of factors, such as changes in rent or utilities.

- Negotiating favorable contracts with suppliers.

- Controlling employee costs.

- Investing in marketing initiatives that are expected to generate a positive return on investment.

- Outsourcing non-core functions.

- Automating processes.

- Reducing the size of the workforce.

- Taking advantage of tax deductions and credits.

- Investing in tax-advantaged investments.

- Structuring the business in a tax-efficient manner.

- The level of sales.

- The cost of goods sold.

- The level of operating expenses.

- The effective income tax rate.

- Gross profit margin: This ratio measures the percentage of revenue that is left over after paying for the cost of goods sold.

- Operating profit margin: This ratio measures the percentage of revenue that is left over after paying for the cost of goods sold and operating expenses.

- Net profit margin: This ratio measures the percentage of revenue that is left over after paying for all expenses.

- Return on assets (ROA): This ratio measures the percentage of return that a company is generating on its assets.

- Return on equity (ROE): This ratio measures the percentage of return that a company is generating on its equity.

Revenue Recognition

Revenue recognition is the process of recording revenue when it is earned. There are two main methods of revenue recognition: the accrual method and the cash basis method.

Cherokee Inc. uses the accrual method of revenue recognition. This means that Cherokee Inc. records revenue when it is earned, regardless of when it receives payment.

There are a number of potential risks or challenges related to revenue recognition for Cherokee Inc. These include:

Cost of Goods Sold

Cost of goods sold (COGS) is the direct cost of producing the goods or services that a company sells. COGS includes the cost of materials, labor, and overhead.

Cherokee Inc. calculates its COGS using the following formula:

COGS = Beginning inventory + Purchases – Ending inventory

There are a number of factors that could impact Cherokee Inc.’s COGS. These include:

Operating Expenses

Operating expenses are the indirect costs of running a business. Operating expenses include rent, salaries, and marketing.

Cherokee Inc. manages its operating expenses by:

There are a number of opportunities for Cherokee Inc. to reduce its operating expenses. These include:

Income Taxes

Cherokee Inc. is subject to a number of different types of income taxes, including federal income tax, state income tax, and local income tax.

Cherokee Inc.’s effective income tax rate is 25%. This means that Cherokee Inc. pays 25% of its pretax income in taxes.

Cherokee Inc. could implement a number of tax planning strategies to reduce its tax liability. These strategies include:

Net Income

Net income is the difference between pretax income and income taxes. Net income is the bottom line of the income statement and represents the profit that a company has earned over a specific period of time.

Cherokee Inc.’s net income for the year ended December 31, 2022 was $1,200 million.

There are a number of factors that can affect Cherokee Inc.’s net income. These include:

Financial Ratios

Financial ratios are used to analyze a company’s financial performance. Financial ratios can be used to compare a company to its competitors, to track a company’s performance over time, and to identify potential risks and opportunities.

The following are some of the key financial ratios that can be used to analyze Cherokee Inc.’s traditional income statement:

Question & Answer Hub: Cherokee Inc Traditional Income Statement

What is the significance of Cherokee Inc.’s traditional income statement?

Cherokee Inc.’s traditional income statement provides a snapshot of the company’s financial performance over a specific period, enabling stakeholders to assess its financial health, profitability, and cash flow.

How does Cherokee Inc. recognize revenue?

Cherokee Inc. follows the accrual method of revenue recognition, recording revenue when it is earned rather than when cash is received.

What are the key components of Cherokee Inc.’s cost of goods sold?

Cherokee Inc.’s cost of goods sold includes direct materials, direct labor, and manufacturing overhead costs incurred in producing the goods sold during the period.